Latest Posts by silentj1018 - Page 2

Nothing but support for Imane Khelif going after every public figure that spread misinformation about her.

Hope JK Rowling in particular gets sued into the ground.

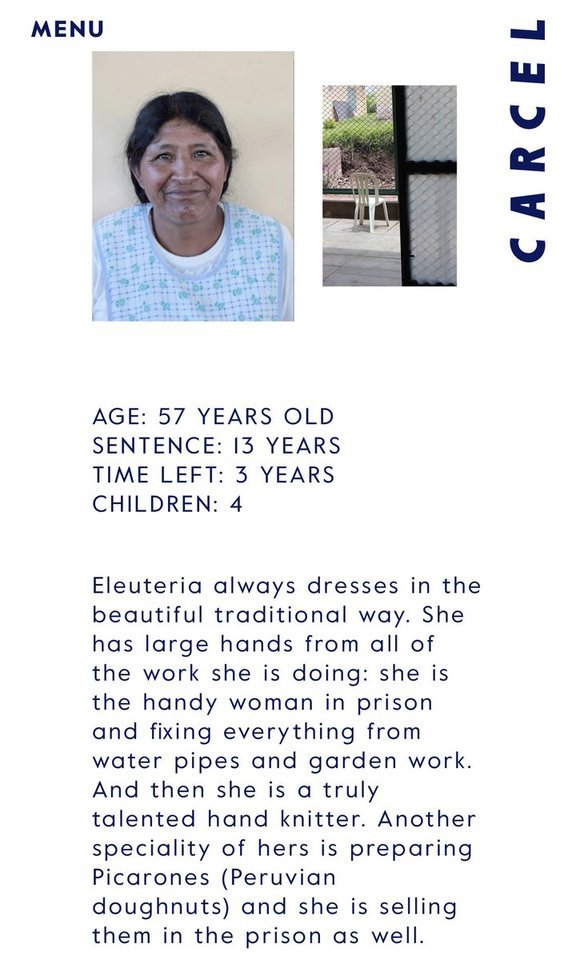

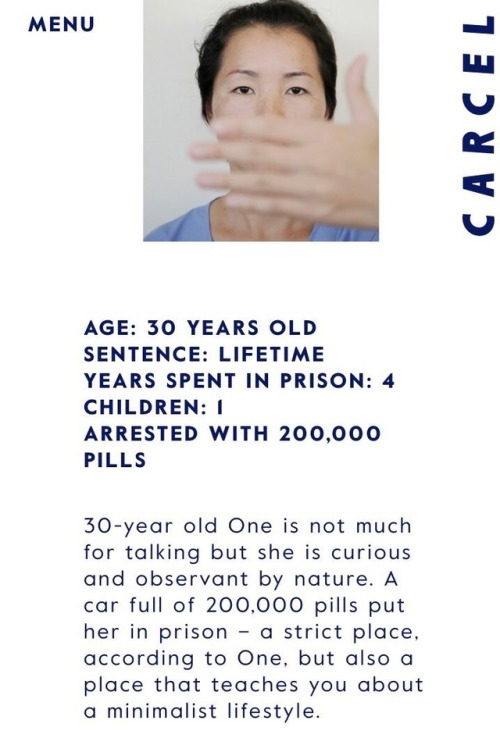

Boy do I have some hot takes on this one

why do people think victorian orphans were like. the peak of sheltered pure innocence

For the record, I looked this person up on Twitter and I think they actually live in Baltimore and seem pretty chill.

I will die in the hill of my driving opinions re: the DMV, however.

This Twitter post was written by a northern Virginia SUV driver, who cut off three people while tweeting and makes jokes about Maryland drivers because they’re too afraid to go into most of DC

On related note, a few years ago, the Entomological Society of America officially discontinued the use of "gypsy moth" and "gyspy ant" as common names for Lymantria dispar and Aphaenogaster araneoides. L. Dispar is now known as the "spongy moth," so named for the appearance of their eggs, but I don't think a new common name has caught on for the ant species yet.

These changes we brought about, in large part, by the advocacy of Romani people in academia. You might not think that bug names are a very serious issue, but I believe that language matters. These species became known as "gypsies" because their attributes were likened to certain stereotypes and negative perceptions of actual Roma, so the continued use of those names reaffirmed those negative associations in the public consciousness. Slurs and pejoratives can never be truly decontexualized.

In my mind, one of the biggest obstacles that Romani people face when we are trying to advocate for ourselves is a lack of recognition as a marginalized group that deserves the necessary consideration. Even for seemingly trivial matters, like bugs or comic book characters, the way that people talk about us-- and talk down to us, when we get involved-- is telling. So, I always think that changes like this are a win, because it means that people are willing to learn and grant us the dignity we deserve. And there's nothing wrong with wanting to effect change in your own field, even arts and science.

This has been playing nonstop in my head it had to be done

Honey get my shotgun there are folkpunks playing bluegrass on their handmade banjos out front again

found a baby turtle in my sewer and used AI aging techniques to work out what it would look like as an adult and used google reverse image search to find images of its parents who were in a nature documentary in 2017 and used harsh economic sanctions to encourage them not to lose their baby in the sewer again

It's a pretty place!

Belgium - Brussel in one minute

You can read the rest of the thread here. Plus here's the 84 page document submitted by South Africa

As much as I love the Stardew Valley spouses it always kinda bugs me that they stay stagnant after you marry them. Like even after having kids and passing a decade in game they look and act the exact same? Anyway what if

Bachelors and Krobus are here!!! Thanks for your patience ^^

(Also if you like these and want to see them smooching YOUR farmer, my commission info is here :3)

This is the funniest video ever

the stardew valley modding community is having a little war over grandpa's bed

(Source)

WOW

This I think is unprecedented, holy shit. All the original characters from Fables and its spinoffs are public domain now!!

Y'all ever make the mistake of trying to buy a taco and going to O'Tacos?

For a while in my life I legitimately considered moving to Germany. There’s multiple reasons I inevitably ended up staying in the US but one of the big ones was that one time when I was in Germany and wanted some salsa the closest thing I could find was basically just tomato sauce.

i love my switch its like an animal to me. shhhh sweet pink and green creature download my software

i hate this stupid fucking video my girlfriend keeps playing it when we’re sharing comfortable moments of silence and it’s ruined by this stupid fucking orange slut getting water boarded by toothpaste

I was reading something about Whitestown, Indiana and my eyes nearly popped out of my head thinking it was one of THOSE comically racist towns. Nice to know, at least the name, wasn’t that.

if you're from the USA, tag what you chose and what general region you're from (don't dox yourself, I don't need to know your hometown or any other security questions), using this map:

I'd also love to know if you were aware of the opposing connotation/definition or any of the various other pronunciations before reading this. I am not the least bit interested in what anyone thinks is ~correct~, only what they use and what they've heard before.

for non-USAmericans, I'm super curious if this linguistic difference exists outside the USA in any way, so I'd love it if you tagged your country as well.

reblog for sample size, you know the drill.

Paying consumer debts is basically optional in the United States

The vast majority of America's debt collection targets $500-2,000 credit card debts. It is a filthy business, operated by lawless firms who hire unskilled workers drawn from the same economic background as their targets, who routinely and grotesquely flout the law, but only when it comes to the people with the least ability to pay.

America has fairly robust laws to protect debtors from sleazy debt-collection practices, notably the Fair Debt Collection Practices Act (FDCPA), which has been on the books since 1978. The FDCPA puts strict limits on the conduct of debt collectors, and offers real remedies to debtors when they are abused.

But for FDPCA provisions to be honored, they must be understood. The people who collect these debts are almost entirely untrained. The people they collected the debts from are likewise in the dark. The only specialized expertise debt-collection firms concern themselves with are a series of gotcha tricks and semi-automated legal shenanigans that let them take money they don't deserve from people who can't afford to pay it.

There's no better person to explain this dynamic than Patrick McKenzie, a finance and technology expert whose Bits About Money newsletter is absolutely essential reading. No one breaks down the internal operations of the finance sector like McKenzie. His latest edition, "Credit card debt collection," is a fantastic read:

https://www.bitsaboutmoney.com/archive/the-waste-stream-of-consumer-finance/

McKenzie describes how a debt collector who mistook him for a different PJ McKenzie and tried to shake him down for a couple hundred bucks, and how this launched him into a life as a volunteer advocate for debtors who were less equipped to defend themselves from collectors than he was.

McKenzie's conclusion is that "paying consumer debts is basically optional in the United States." If you stand on your rights (which requires that you know your rights), then you will quickly discover that debt collectors don't have – and can't get – the documentation needed to collect on whatever debts they think you owe (even if you really owe them).

The credit card companies are fully aware of this, and bank (literally) on the fact that "the vast majority of consumers, including those with the socioeconomic wherewithal to walk away from their debts, feel themselves morally bound and pay as agreed."

If you find yourself on the business end of a debt collector's harassment campaign, you can generally make it end simply by "carefully sending a series of letters invoking [your] rights under the FDCPA." The debt collector who receives these letters will have bought your debt at five cents on the dollar, and will simply write it off.

By contrast, the mere act of paying anything marks you out as substantially more likely to pay than nearly everyone else on their hit-list. Paying anything doesn't trigger forbearance, it invites a flood of harassing calls and letters, because you've demonstrated that you can be coerced into paying.

But while learning FDCPA rules isn't overly difficult, it's also beyond the wherewithal of the most distressed debtors (and people falsely accused of being debtors). McKenzie recounts that many of the people he helped were living under chaotic circumstances that put seemingly simple things "like writing letters and counting to 30 days" beyond their needs.

This means that the people best able to defend themselves against illegal shakedowns are less likely to be targeted. Instead, debt collectors husband their resources so they can use them "to do abusive and frequently illegal shakedowns of the people the legislation was meant to benefit."

Here's how this debt market works. If you become delinquent in meeting your credit card payments ("delinquent" has a flexible meaning that varies with each issuer), then your debt will be sold to a collector. It is packaged in part of a large spreadsheet – a CSV file – and likely sold to one of 10 large firms that control 75% of the industry.

The "mom and pops" who have the other quarter of the industry might also get your debt, but it's more likely that they'll buy it as a kind of tailings from one of the big guys, who package up the debts they couldn't collect on and sell them at even deeper discounts.

The people who make the calls are often barely better off than the people they're calling. They're minimally trained and required to work at a breakneck pace. Employee turnover is 75-100% annually: imagine the worst call center job in the world, and then make it worse, and make "success" into a moral injury, and you've got the debt-collector rank-and-file.

To improve the yield on this awful process, debt collection companies start by purging these spreadsheets of likely duds: dead people, people with very low credit-scores, and people who appear on a list of debtors who know their rights and are likely to stand on them (that's right, merely insisting on your rights can ensure that the entire debt-collection industry leaves you alone, forever).

The FDPCA gives you rights: for example, you have the right to verify the debt and see the contract you signed when you took it on. The debt collector who calls you almost certainly does not have that contract and can't get it. Your original lender might, but they stopped caring about your debt the minute they sold it to a debt-collector. Their own IT systems are baling-wire-and-spit Rube Goldberg machines that glue together the wheezing computers of all the companies they've bought over the last 25 years. Retrieving your paperwork is a nontrivial task, and the lender doesn't have any reason to perform it.

Debt collectors are bottom feeders. They are buying delinquent debts at 5 cents on the dollar and hoping to recover 8 percent of them; at 7 percent, they're losing money. They aren't "large, nationally scaled, hypercompetent operators" – they're shoestring operations that can only be viable if they hire unskilled workers and fail to train them.

They are subject to automatic damages for illegal behavior, but they still break the law all the time. As McKenzie writes, a debt collector will "commit three federal torts in a few minutes of talking to a debtor then follow up with a confirmation of the same in writing." A statement like "if you don’t pay me I will sue you and then Immigration will take notice of that and yank your green card" makes the requisite three violations: a false threat of legal action, a false statement of affiliation with a federal agency, and "a false alleged consequence for debt nonpayment not provided for in law."

If you know this, you can likely end the process right there. If you don't, buckle in. The one area that debt collectors invest heavily in is the automation that allows them to engage in high-intensity harassment. They use "predictive dialers" to make multiple calls at once, only connecting the collector to the calls that pick up. They will call you repeatedly. They'll call your family, something they're legally prohibited from doing except to get your contact info, but they'll do it anyway, betting that you'll scrape up $250 to keep them from harassing your mother.

These dialing systems are far better organized than any of the company's record keeping about what you owe. A company may sell your debt on and fail to keep track of it, with the effect that multiple collectors will call you about the same debt, and even paying off one of them will not stop the other.

Talking to these people is a bad idea, because the one area where collectors get sophisticated training is in emptying your bank account. If you consent to a "payment plan," they will use your account and routing info to start whacking your bank account, and your bank will let them do it, because the one part of your conversation they reliably record is this payment plan rigamarole. Sending a check won't help – they'll use the account info on the front of your check to undertake "demand debits" from your account, and backstop it with that recorded call.

Any agreement on your part to get on a payment plan transforms the old, low-value debt you incurred with your credit card into a brand new, high value debt that you owe to the bill collector. There's a good chance they'll sell this debt to another collector and take the lump sum – and then the new collector will commence a fresh round of harassment.

McKenzie says you should never talk to a debt collector. Make them put everything in writing. They are almost certain to lie to you and violate your rights, and a written record will help you prove it later. What's more, debt collection agencies just don't have the capacity or competence to engage in written correspondence. Tell them to put it in writing and there's a good chance they'll just give up and move on, hunting softer targets.

One other thing debt collectors due is robo-sue their targets, bulk-filing boilerplate suits against debtors, real and imaginary. If you don't show up for court (which is what usually happens), they'll get a default judgment, and with it, the legal right to raid your bank account and your paycheck. That, in turn, is an asset that, once again, the debt collector can sell to an even scummier bottom-feeder, pocketing a lump sum.

McKenzie doesn't know what will fix this. But Michael Hudson, a renowned scholar of the debt practices of antiquity, has some ideas. Hudson has written eloquently and persuasively about the longstanding practice of jubilee, in which all debts were periodically wiped clean (say, whenever a new king took the throne, or once per generation):

https://pluralistic.net/2020/03/24/grandparents-optional-party/#jubilee

Hudson's core maxim is that "debt's that can't be paid won't be paid." The productive economy will have need for credit to secure the inputs to their processes. Farmers need to borrow every year for labor, seed and fertilizer. If all goes according to plan, the producer pays off the lender after the production is done and the goods are sold.

But even the most competent producer will eventually find themselves unable to pay. The best-prepared farmer can't save every harvest from blight, hailstorms or fire. When the producer can't pay the creditor, they go a little deeper into debt. That debt accumulates, getting worse with interest and with each bad beat.

Run this process long enough and the entire productive economy will be captive to lenders, who will be able to direct production for follies and fripperies. Farmers stop producing the food the people need so they can devote their land to ornamental flowers for creditors' tables. Left to themselves, credit markets produce hereditary castes of lenders and debtors, with lenders exercising ever-more power over lenders.

This is socially destabilizing; you can feel it in McKenzie's eloquent, barely controlled rage at the hopeless structural knot that produces the abusive and predatory debt industry. Hudson's claim is that the rulers of antiquity knew this – and that we forgot it. Jubilee was key to producing long term political stability. Take away Jubilee and civilizations collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Debts that can't be paid won't be paid. Debt collectors know this. It's irrefutable. The point of debt markets isn't to ensure that debts are discharged – it's to ensure that every penny the hereditary debtor class has is transferred to the creditor class, at the hands of their fellow debtors.

In her 2021 Paris Review article "America's Dead Souls," @MollyMcGhee gives a haunting, wrenching account of the debts her parents incurred and the harassment they endured:

https://www.theparisreview.org/blog/2021/05/17/americas-dead-souls/

After I published on it, many readers wrote in disbelief, insisting that the debt collection practices McGhee described were illegal:

https://pluralistic.net/2021/05/19/zombie-debt/#damnation

And they are illegal. But debt collection is a trade founded on lawlessness, and its core competence is to identify and target people who can't invoke the law in their own defense.

Going to Defcon this weekend? I’m giving a keynote, “An Audacious Plan to Halt the Internet’s Enshittification and Throw it Into Reverse,” today (Aug 12) at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/12/do-not-pay/#fair-debt-collection-practices-act

SoCal Gas spent millions on astroturf ops to fight climate rules

Today (19 Aug), I'm appearing at the San Diego Union-Tribune Festival of Books. I'm on a 2:30PM panel called "Return From Retirement," followed by a signing:

https://www.sandiegouniontribune.com/festivalofbooks

It's a breathtaking fraud: SoCal Gas, the largest gas company in America, spent millions secretly paying people to oppose California environmental regulations, then illegally stuck its customers with the bill. We Californians were forced to pay to lobby against our own survival:

https://www.sacbee.com/news/politics-government/capitol-alert/article277266828.html

The criminal scheme is spelled out in eye-watering detail in a superb investigative report by Joe Rubin and Ari Plachta for the Sacramento Bee, which names the law firms and individual lawyers involved in the scam.

Here's the situation: SoCal Gas is California's private, regulated gas monopoly. They are allowed to lobby, but are legally required to charge their lobbying activities to their shareholders, and are prohibited from raising customer rates to pay for lobbying.

The company spent years secretly violating this rule, in the sleaziest way possible: working with corporate cartels like the California Restaurant Association and BizFed, the monopoly paid BigLaw white-shoe firms to procure people who posed as concerned citizens in order to oppose climate regulations that are essential to the state's very survival.

The bill topped $36 million – and it was illegally charged to its customers, the Californians whose immediate health and long-term survival these efforts opposed. SoCal Gas refuses to disclose the full extent of the spending, as do its lawyer-procurers, who cite legal confidentiality and a First Amendment right to secretly seek to influence policy in their refusal to disclose their profits from this illegal conduct.

The law firms involved are a who's-who of California's most prominent corporate fixers, including Reichman Jorgensen and Holland & Knight. The partners involved have a long rap sheet for anti-climate dirty tricking, most notably Jennifer Hernandez, notorious in climate justice history for an incident where activists claim she posed as one of them, infiltrating a campaign to force corporate despoilers to clean up their pollution in order to sabotage it, while secretly on a wealthy, prominent landowner's payroll.

Hernandez claims to care about the environment and says that her longstanding, corporate-funded, extensive campaigns and lawsuits against state environmental regulations are motivated by concern over their impact on working people. Her firm, Holland & Knight, denies serving SoCal Gas in opposing gas regulations, but it received $594k in ratepayer dollars, and submitted comments opposing the rules on its own behalf. Those comments were nearly identical to the comments submitted by SoCal Gas.

Hernandez also represents an obscure organization called The Two Hundred for Home Ownership in "a flurry of lawsuits" over California Air Resources Board rules on pollution, seeking to overturn the state's landmark climate change regulations.

Two Hundred for Home Ownership was founded by Robert Apodaca, who told the Bee that Hernandez's work for him is pro bono and not funded by SoCal Gas, but his entry into the fray occurred just as SoCalGas was founding an astroturf group called Californians for Fair and Balanced Energy (C4BES), which pretended to be an independent organization, disguising its relationship with SoCal Gas.

Apodaca is also founder of United Latinos Vote, an organization that had been largely dormant for seven years, not receiving any donations, until 2018, when the California Building Industry Association gave it $99k. The CBIA is a large-dollar recipient of donations from SoCal Gas, and its CEO insists that it was not acting on SoCal Gas's behalf when it made its unpredented donation to Apodaca.

The CBIA donation to United Latinos Vote was forerunner to a flood of corporate donations from the likes of Chevron, Marathon and Phillips 66. Shortly after receiving this cash, United Latinos Vote ran a full page ad in the LA Times, accusing the Sierra Club of pushing for anti-gas appliance rules that would harm working class Latino families.

This ad, in turn, featured prominently in advocacy by the SoCal Gas front group C4BES, funded with $29.1m in ratepayer money, which it then spent seeking to link clean appliance rules with anti-Latino racism. A quarter of California's carbon emissions come from home gas use.

SoCal Gas is regulated by the California Public Utility Commission (CPUC), which tolerated this mounting illegal conduct for many years, even as the company circulated internal memos as early as 2015 discussing its plans to oppose electrification in the state on the basis that it constituted "a significant risk to our business."

But last year, CPUC fined SoCal Gas $10m. Now, CPUC's Public Advocate office has filed a damning, extensive report on SoCal Gas's unlawful conduct, seeking $80m in rate cuts to compensate Californians for the funds misappropriated to protect the company's shareholder interests:

https://docs.cpuc.ca.gov/PublishedDocs/Efile/G000/M517/K407/517407314.PDF

Additionally, the Public Advocate is demanding $233m in fines for the company's refusal to allow investigators to audit its books and discover the full extent of the fraud.

SoCal Gas is the nation's largest utility, but (incredibly), it's not the dirtiest. That prize goes to Ohio's FirstEnergy, which handed $60m in ratepayer dollars to state politicians in illegal bribes in exchange for coal and nuclear subsidies and cancellation of state climate rules. That scandal led to GOP speaker of the Ohio House Larry Householder being sentenced to 20 years in prison:

https://en.wikipedia.org/wiki/Ohio_nuclear_bribery_scandal

There is something extraordinarily sleazy about using ratepayers' own money to lobby against their interests. SoCal Gas and its Big Law enablers have funneled millions in Californian's money into campaigns to poison us and boil us alive, and they did it while using workers and racialized people as human shields.

I'm kickstarting the audiobook for "The Internet Con: How To Seize the Means of Computation," a Big Tech disassembly manual to disenshittify the web and make a new, good internet to succeed the old, good internet. It's a DRM-free book, which means Audible won't carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/19/cooking-the-books-with-gas/#reichman-jorgensen

Image: Maryland GovPics (modified) https://www.flickr.com/photos/mdgovpics/6635539089/

Jackie (modified) https://www.flickr.com/photos/79874304@N00/197532792

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/

i hate seeing people now making fun of those who care about privacy online. i've seen people saying things like "well they already have your data. what are companies going to do with it" and it's like, that's not the point. it's that companies /shouldn't/ be able to have my data and sell it. am i aware they probably already have my data? yes, absolutely. but i'm still going to try and keep them from monetizing it any further, why are we defending companies selling data they shouldn't have to begin with though?

So I ended up with free time at the end of my first class today, so I was like "do yall wanna see a vintage meme?" and turned on "what does the fox say". Expected like. A laugh from the kids, or even just a "wtf is this mx?" which is. A reasonable reaction to What Does The Fox Say.

But instead of a reasonable reaction. all of my students watched the first 60 seconds with jaws agape. And then this one kids turns to me like the fucking eye of Sauron and literally goes: